“Give me control of a nation’s money and I care not who makes the laws.”

Amschel Rothschild

Definition

“Money is any item or verifiable record that is generally accepted as payment for goods and services and repayment of debts, such as taxes, in a particular country or socio-economic context.[1][2][3] The main functions of money are distinguished as: a medium of exchange, a unit of account, a store of value and sometimes, a standard of deferred payment.[4][5] Any item or verifiable record that fulfils these functions can be considered as money.

Money is historically an emergent market phenomenon establishing a commodity money, but nearly all contemporary money systems are based on fiat money.[4]Fiat money, like any check or note of debt, is without use value as a physical commodity. It derives its value by being declared by a government to be legal tender; that is, it must be accepted as a form of payment within the boundaries of the country, for “all debts, public and private”.[6]

The money supply of a country consists of currency (banknotes and coins) and, depending on the particular definition used, one or more types of bank money (the balances held in checking accounts, savings accounts, and other types of bank accounts). Bank money, which consists only of records (mostly computerized in modern banking), forms by far the largest part of broad money in developed countries.[7][8][9]

Wikipedia contributors. “Money.” Wikipedia, The Free Encyclopedia.

‘I’ have added emphasis to various parts above as ‘I’ want to highlight some of the agreed definitions of what this thing WE all call and accept as money REALLY is to you at this early stage in this section as money plays such a fundamental role in OUR collective Human experience today.

Without your own access to and store of modern money you have restricted access to EVERYTHING WE as Humans need to survive yet most of us have never stopped to question what modern money actually is!?

Time Out

Think how many days you could survive without earning or spending ANY of what WE all consider money today?

Some fellow Humans have recently tried via something on Social media called #NoSpendChallenge – more here

Brief History of Money

Before our current system of money, Humans would simply barter (swap) extra cattle, grain and other goods they produced with others they came into contact with who had items they needed or wanted. However as far back as 30,000 years ago Humans were using items called tally sticks to keep a record of what goods were theirs and what they owed to others in a similar way to what WE would think of today as the practice of accounting.

In ancient Egypt and other long established civilisations, items such as clay tokens were used to pay workers and as items to trade as these could then be redeemed for the actual goods at large grain stores and suchlike. In China, around 1100 BC, small, longer lasting, bronze replicas of goods were cast meaning yet more trade could occur without having to physically have and carry your large and heavy items with you to trade. Then in around 600 BC in modern day Turkey, what we know as an ‘official’ currency was minted (created) by King Alyattes there and the idea spread via commerce and trade around the World.

Paper money, in the form of banknotes followed during the 11th century via the Song Dynasty in China and again, the concept then caught on in other parts of the World.

For a much more detailed history of money make sure you visit Wikipedia here however what ‘I’ would like to focus on, in terms of the history of money, is the idea that money was widely accepted only when it was physically made of something deemed valuable. That is, it was only accepted in place of the physical item or service Humans were trading when it had an intrinsic value such as the gold and silver coins of the past…

“Gold was a preferred form of money due to its rarity, durability, divisibility, fungibility and ease of identification,[57] often in conjunction with silver. Silver was typically the main circulating medium, with gold as the monetary reserve.”

Wikipedia contributors. “Gold standard.” Wikipedia, The Free Encyclopedia

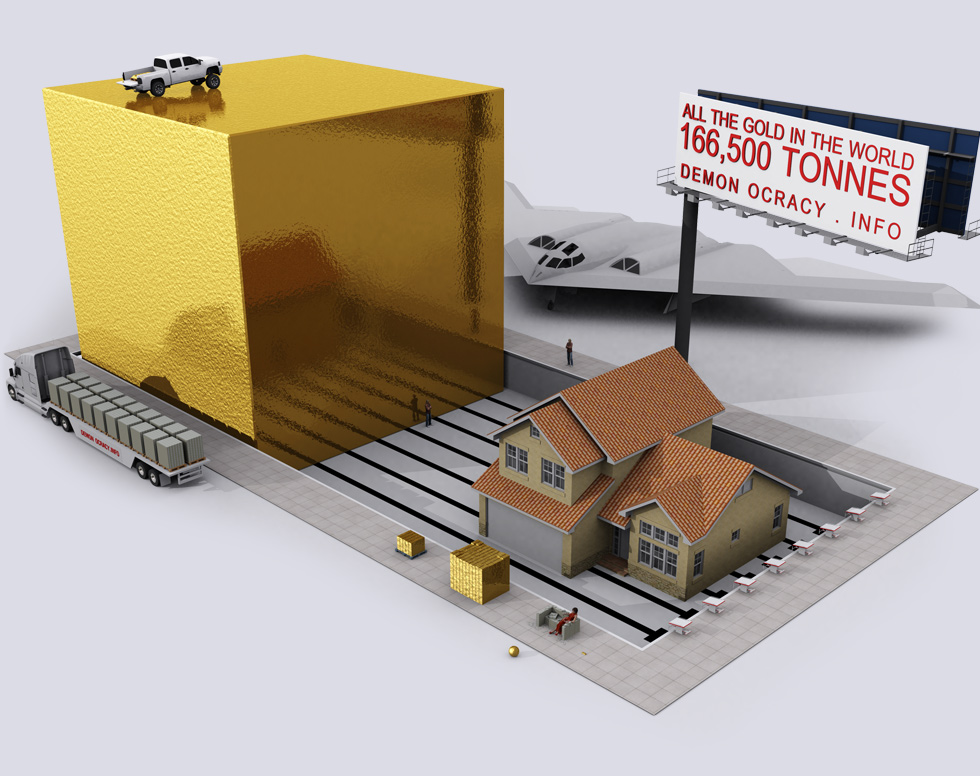

As per the above definition, Gold was, and still is in many Countries in the World, the preferred store of Human effort (wealth) or what most of us today have been told is money. Critically, gold also has a limited (finite) supply in terms of how much of it can ever be removed from the ground on Earth, the same as silver and other precious metals.

This rarity is important because it means you can be sure that if you own some of this limited supply of gold it can’t be diluted or suffer from what is termed debasement unlike OUR current physical coins.

Image via http://demonocracy.info

A Gold Standard

‘I’ briefly mentioned the introduction of banknotes within the modern money system on the World stage earlier, however ‘I’ would like to share the definition the Bank of England themselves currently give for them…

“Banknotes were originally IOUs for gold deposits held at the Bank of England. People used them to pay for things safe in the knowledge that they were backed by the promise to pay the equivalent value in gold.

This confidence in banknotes is important for keeping the whole economy functioning.“

As per the above, banknotes used to be IOUs (I owe yous) – that is paper notes which you could trade back to the bank for physical gold whenever you wanted under what was known as a gold standard.

This gold standard, made it difficult for governments to inflate (increase) prices for the goods and services WE use by expanding (increasing) the money supply. High inflation was rare when Countries were on a Gold Standard as the amount of money in the system could only grow at the same rate that the gold supply increases. As WE have seen above, there is only a limited (finite) amount of Gold on Earth that has been mined and is able to be mined in the future.

“In the absence of the gold standard, there is no way to protect savings from confiscation through inflation […] Deficit spending is simply a scheme for the “hidden” confiscation of wealth. Gold stands in the way of this insidious process. It stands as a protector of property rights.”

Alan Greenspan, Gold and Economic Freedom (1968)

This natural limitation to a nation’s money supply was simply no good for those in positions of REAL power looking to increase THEIR wealth.

Going all the way back to the USA in 1913, the Federal Reserve was created as, what is commonly called a central bank. The main reasons given for it’s creation were the following…

“It was created by the Congress to provide the nation with a safer, more flexible, and more stable monetary and financial system.”

Just one year later, after the start of World War I, President Woodrow Wilson then gave the new Federal Reserve the ability in law to print more money by taking the United States off the gold standard. There was now no limit to how much money could be pumped into the system as the notes themselves were now not linked to the limited amount of gold in the World.

After World War I, starting in 1929, what was known as the the Great Depression devastated large parts of the World and it has been argued that the Federal Reserve not only failed to prevent the crisis but actually was primarily responsible for it…

“Not only did the Federal Reserve fail to prevent the Great Depression but it was primarily responsible for its length and severity. The Federal Reserve controls the money supply and would never exist in a true free market economy.”

Then in 1933, President Franklin D. Roosevelt actually passed Executive_Order_6102 “forbidding the hoarding of gold coin, gold bullion, and gold certificates within the continental United States”.

Various reasons were given at the time for the above order (see Wikipedia’s list of these) however once USA citizen’s were forced to sell this ancient store of Human value to the Government (at below market rates) the World’s monetary path was altered for ever. This deliberate decision led to what is known as the Bretton Woods Agreement in 1944 which lasted until the 1970s when President Nixon announced the U.S would no longer exchange gold for it’s currency.

Today, nearly every Human on the planet lives in a nation with a central bank controlling the creation, distribution and policies of the money WE use and which is the store of OUR Human value.

Problems

“It is well enough that people of the nation do not understand our banking and monetary system, for if they did, I believe there would be a revolution before morning.“

Henry Ford

Your physical money has no worth

Again the Bank of England themselves say this openly on their web site…

“The reason money works when you pay for things is because people trust in its value.“

https://www.bankofengland.co.uk/knowledgebank/why-does-money-depend-on-trust

Even though OUR currency – the coins and bank notes WE work hard for now have no actual value, Governments then benefit further from the currency they make us use. Seigniorage as it is known, is the amount of profit that goes to the Government comprised of the difference between how much it costs them to produce a note and their face value. Taking the £10 note as an example, each note only costs around 3p or 4p to produce but is sold to high street banks at face value, so in this case £10 but the actual worth of £10 note, (unlike gold) is 4p!

Where does modern money come from?

You might think this is an easy question and you know the answer?

Well you would be right if you said the Royal Mint as a UK citizen as they do supply all of the nation’s coins. The Bank of England also supply ALL of the UK’s bank notes but did you know notes and coins make up less than 3% of ALL the money in the UK economy!

Again the Bank of England themselves publicly state that most people’s view of how money is created “is often misunderstood“…

“In the modern economy, most money takes the form of bank deposits. But how those bank deposits are created is often misunderstood. The principal way in which they are created is through commercial banks making loans: whenever a bank makes a loan, it creates a deposit in the borrower’s bank account, thereby creating new money. This description of how money is created differs from the story found in some economics textbooks.“

The following video by the UK campaign group http://www.positivemoney.org/ might explain the above a little better than ‘I’ can…

“In the UK WE pay the banks £192,000,000 in interest EVERY day“

Postivemoney.org

Time out

Given all of the above, do you think it’s a coincidence WE are never taught how the money WE trade our precious Human time for is actually created and how the banking system really functions?

Modern money, such as the € £ and $ are what WE rely on as the primary record or store of OUR efforts today.

Unfortunately in today’s society, often your total amount of money is also seen by many to represent your worth as a Human 😧

Should you really take pride in having the most money when WE have already seen the current banking and monetary system is designed to create division between us?

The current monetary system also does not give you full control of your value to the Human Race in various ways that most of us don’t even question…

Your store of value is only worth what everyone else thinks it’s worth

Taking the main € £ $ notes and coins most of us are familiar with. As we have seen above, ALL of these are literally NOT worth the value they have written on them today unless WE all believe them to be worth that. you can also obviously no longer swap these notes for gold as per the end of the gold standard linked above. This is the same for the coins WE all use.

Returning to the idea of debasement from earlier again, if you had 1p and 2p coins in the UK that were created (minted) before 1992 then these were actually made of 97% copper. When the newer 1p and 2p coins were released after 1992, their intrinsic worth was actually diluted as the amount of copper used was substantially reduced (debasement). This meant the old coins were actually worth more for their copper content than their old face value BUT the authorities deemed it illegal for any owners of these coins to melt them down to realise their true worth!

You also have no control of what value others who buy, sell and trade your € £ $ store of value place on it. See Hyperinflation in Zimbawe for more of what can happen when the confidence tricks fail alongside Argentina as of September 2019

Your money in a bank is NOT yours

‘I’ know the above might sound ridiculous as you have been told from an early age NOT to keep your money under your mattress or at home as it’s safer in the banks and THEY used to even pay you something called interest to look after it for you but the fact of the matter is…

Let me explain further, the moment you pass over all those hard earned bank notes and coins you effectively become what is known as a creditor.

Your new status as a creditor means you get a receipt for your deposit BUT if the bank or building society gets into financial difficulties you and your money will be in the same queue as EVERY OTHER retail customer.

Shareholders in the bank usually get anything that’s left of the bank or it’s “assets” before you too so if there is a ‘bank run’ you are very unlikely to get ANYTHING back that was yours.

During the Global banking crisis of 2007 and 2008 the UK saw Northern Rock become the first British bank to fail for 150 years due to a bank run.

“A bank run (also known as a run on the bank) occurs when many clients withdraw their money from a bank, because they believe the bank may cease to function in the near future. In other words, it is when, in a fractional-reserve banking system (where banks normally only keep a small proportion of their assets as cash), numerous customers withdraw cash from deposit accounts with a financial institution at the same time because they believe that the financial institution is, or might become, insolvent; they keep the cash or transfer it into other assets, such as government bonds, precious metals or gemstones. ”

Wikipedia contributors. “Bank run.” Wikipedia, The Free Encyclopedia

The key phrase in the definition above is something known as Fractional Reserve Banking.

Fractional Reserve Banking

“The modern banking process manufactures currency out of nothing. The process is perhaps the most astounding piece of slight hand that was ever invented…If you want to be slaves of the bankers, and pay the cost of your own slavery, then let the banks create currency”

Lord Josiah Stemp, Former Director of the Bank of England (1937)

In order for the current modern banking system to operate, a bank is legally allowed to take your money and then gamble invest this into other companies via stocks or various other practices. This is the KEY reason why a bank run can occur – not only is your money no longer yours when you give it to a bank BUT it’s legally allowed to not even keep it IN the bank anymore!

The only reason other UK banks did not suffer the same fate as Northern Rock via other bank runs was because the Government stepped in and extended the money confidence trick on behalf of the banks. What they did was create a new GUARANTEE for up to £85,000 per person, per bank under something known as the Financial Services Compensation Scheme. More on that here.

So are your stores of money safe in UK banks or other international banks unless there is a bank run?

Sometimes there doesn’t even need to be a ‘bank run’. In 2013 bank customers in Cyprus who happened to have over £85,000 of THEIR money in THEIR bank accounts had this confiscated – read more about that here.

Why?

“It’s the monetary system that provides the foundation for International dominance and National control”

Taken from 97% Owned in 2012

The World’s most powerful people, corporations and countries have a massive vested interest to keep things as they are – they are benefiting massively from maintaining the status quo and creating 97% of OUR money. If you have just under 1 hour to invest further in this then I highly recommend the following video called 97% Owned

Cryptocurrency – the future of money

‘I’ and a lot of the people who first started working with and truly recognising the internet’s potential for enabling a better future for Humans believe that cryptocurrency is the way forward.

‘I’ also personally believe a type of crypto currency called Bitcoin is the best cryptocurrency you can own and use today as it’s the most democratic and decentralised form of money WE have today.

The following video explains the general principles of Bitcoin well…

There is also a great article here explaining how Bitcoin sits within the wider changes technology, as part of what I refer to as the Virtual Collective Consciousness WE Humans have already created. Such developments are great examples of the wider systemic changes that are already (4th Industrial Revolution?) and will be gathering pace going forward into the 2020s. These changes can also be thought of as part of what ‘I’ have called the #HumanReEvolution and this text and movement is MY attempt to play My part within this 🙏

The following amusing video also explains the key differences between the current money system WE are forced to work for, and with today, and the new cryptocurrency ideas in a very novel way 👊

Central Bank Digital Currency – CBDC

Central Bank Digital Currency (CBDC) is going to be something you will be hearing a lot about soon if you haven’t already. These are digital versions of the $, £, and ¥ etc you use and are aware of now BUT will be using Central Banks own ‘block chain’ style technology and be a centralised replacement for fiat money. China for instance is already trialling these CBDCs via it’s citizens and other countries are looking to do the same – see this news article dated February 16th 2021 for example. The following is taken from that article with emphasis added by myself…

A central bank digital currency (CBDC) is a “central bank-issued digital money denominated in the national unit of account, and it represents a liability of the central bank,” the BIS says. Unlike existing e-money and cryptocurrencies, the bank continues, a CBDC represents a direct claim on a central bank rather than a liability on a private financial institution.

A BIS survey released in January revealed that 86% of 65 central banks that responded were actively engaged in some form of CBDC work. Nearly 60% said it was either “likely” or “possible” that they would issue a CBDC for retail use in the next six years.

Nikkei Asia here

However please don’t be fooled that these CBDCs will give you any more power over your life – in fact they will do the exact opposite! These CBDCs will make it possible for Central Banks (Governments) to track EVERY single purchase you make, limit the supply and circulation of these at will and most scarily of all potentially freeze or restrict access to all of your money at the push of a button by police or other central agencies!

Government’s will also probably force any future welfare / benefits payments to these new digital currencies rather than your current method of receiving state help. So what you say?

Well these new fully digital Central Bank Digital Currencies mean they can potentially tell you how quickly you can spend such payments on, what you can spend your money on and where – maybe you won’t be allowed to spend more than 10 Digital $ per week on non state approved ‘services’ or items etc 😦

Hopefully the brief overview of crypto currency and particularly Bitcoin above have given you at least a basic understanding of how revolutionary the future of money can be? Regardless, the following two pieces of information are key to using the future of money…

All that is needed to send money to ANYONE around the world is for you to have a crypto wallet and the other person’s crypto address.

Crypto wallets – Click here to see the various free options available for buying and holding BTC Bitcoin on mobile devices, computers and psychical hardware such as specialist encrypted USB sticks.

Crypto address: An example of Bitcoin (BTC) address is bc1ql3wn2fdkfxj0hzujrv7zslqs520n85pwcn4js8 which is Human ReEvolution’s one. This can also be seen via the QR code version on the right and in the footer of every page for any donations you want to contribute to support the Human ReEvolution 🤞

An alternative to creating your own Crypto Wallet is to use an online Crypto exchange. Coinbase.com is an easy to use (but expensive in terms of fees!) app or web site based way to start your crypto currency journey. These crypto exchanges will let you create a crypto wallet on their secure serves meaning as as long as you remember and secure your details to them you don’t have to worry about losing your Bitcoins.

NOTE – with all of the above you don’t have to actually have ANY Bitcoins to create your first crypto wallet 👍

Is money stopping you from becoming the best you?

Actions you can take now to stop this…

- Try to use coins and notes NOT private bank money based on debt such as debit cards and internet banking when spending. Private banks control ALL digital money EXCEPT decentralised Crypto currencies such as Bitcoin.

- Download your first crypto wallet for free here. See how simple it is to generate a receiving address. Learn more about crypto currencies such at Bitcoin (BTC) and why these give people like you more freedom and trouble those currently in power.

- Look to try and create your own money locally such as the Bristol Pound or maybe encourage local companies to accept crypto currency.

- Investigate and offer your support to campaigns such as Positive Money who want to change the current standard fiat money system.

- Ask your current bank where your money is being invested by them and if you don’t like this move your money to another bank, building society or credit union as per Triodos.co.uk

- Talk to others about this page, share it on social media and ask questions via OUR community area HERE

Time Out

PLEASE take as much time as you need to FULLY read and re read this section as it’s one of the most important in this whole work.

If you don’t see this you will continue to fall for one of the largest confidence tricks Humans have EVER fallen for!

Do you really want to continue to trade your precious Human time on Earth and worth for and in support of OUR current money system and those who control it and us?